Overview of FMR LLC (Trades, Portfolio)’s Recent Transaction

On September 30, 2024, FMR LLC (Trades, Portfolio) executed a significant transaction involving the sale of 2,281,896 shares of TransMedics Group Inc (NASDAQ:TMDX), a leader in advanced organ transplant technology. This move reduced FMR LLC (Trades, Portfolio)’s holdings in the company by 50.82%, leaving them with a total of 2,208,308 shares. The shares were traded at a price of $157 each, reflecting a strategic adjustment in FMR LLC (Trades, Portfolio)’s investment portfolio. This reduction has a minor portfolio impact of -0.02% but signifies a substantial change in the firm’s stake in TransMedics, adjusting their position to 6.60% of their total holdings.

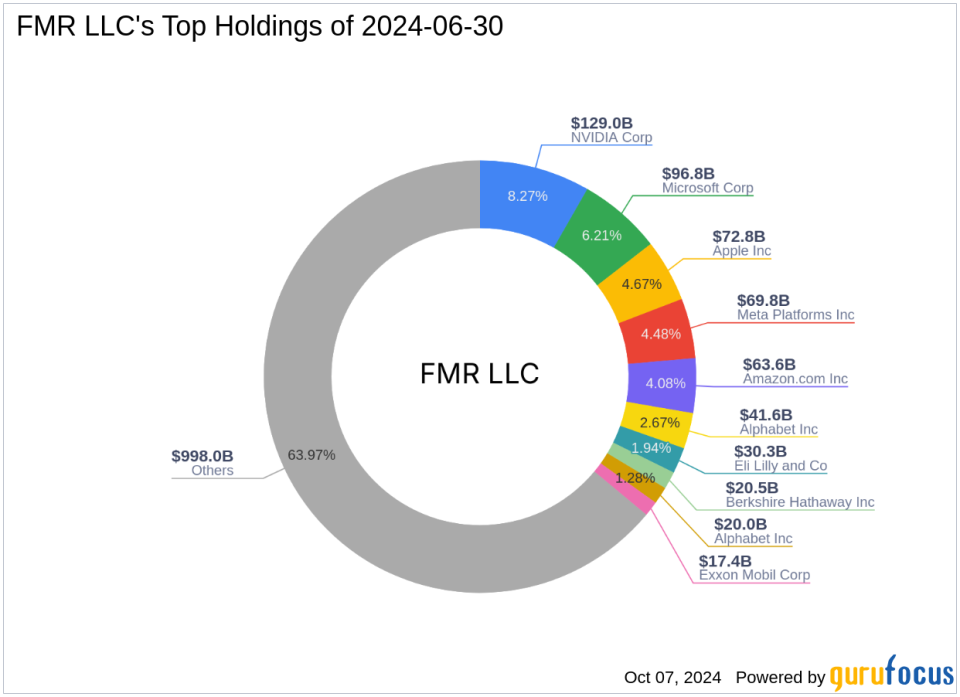

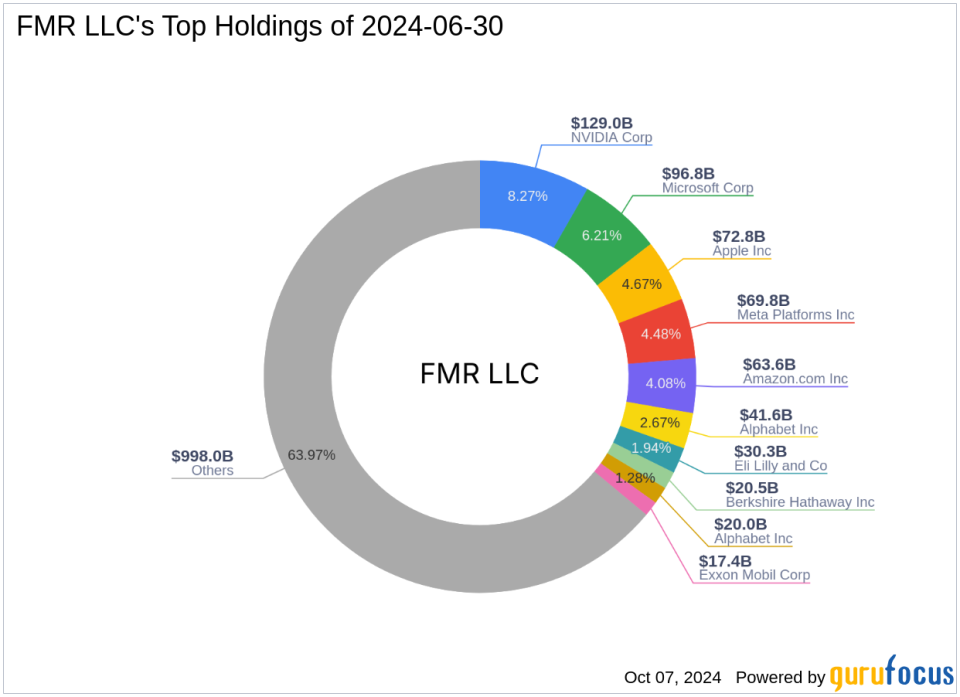

FMR LLC (Trades, Portfolio): A Legacy of Innovation and Growth

FMR LLC (Trades, Portfolio), commonly known as Fidelity, was established in 1946 and has grown into a powerhouse in investment management, known for its pioneering strategies and significant market influence. The firm has consistently focused on high-growth potential stocks and innovative financial products, leading to the creation of some of the world’s largest mutual funds and a robust portfolio of services. Fidelity’s approach combines aggressive research and a keen eye for market trends, maintaining its status as a leader in the financial sector.

TransMedics Group Inc: Revolutionizing Organ Transplants

TransMedics Group Inc, based in the USA, is at the forefront of the medical devices industry, specializing in the Organ Care System (OCS). This innovative system addresses the critical limitations of traditional cold storage organ preservation methods by maintaining organs in a near-physiologic state until transplantation. Since its IPO on May 2, 2019, TransMedics has shown impressive market growth, with a current market capitalization of $4.52 billion and a stock price of $135.63, despite a high PE ratio of 3390.75 indicating potential overvaluation concerns.

Impact of the Trade on FMR LLC (Trades, Portfolio)’s Portfolio

The recent reduction in TMDX shares by FMR LLC (Trades, Portfolio) could reflect a strategic realignment or risk management adjustment given the stock’s high valuation and the volatile nature of the biotechnology sector. Holding 6.60% of their portfolio in TMDX, the adjustment is notable but remains a small fraction of FMR LLC (Trades, Portfolio)’s extensive portfolio, which is heavily weighted in technology and healthcare sectors.

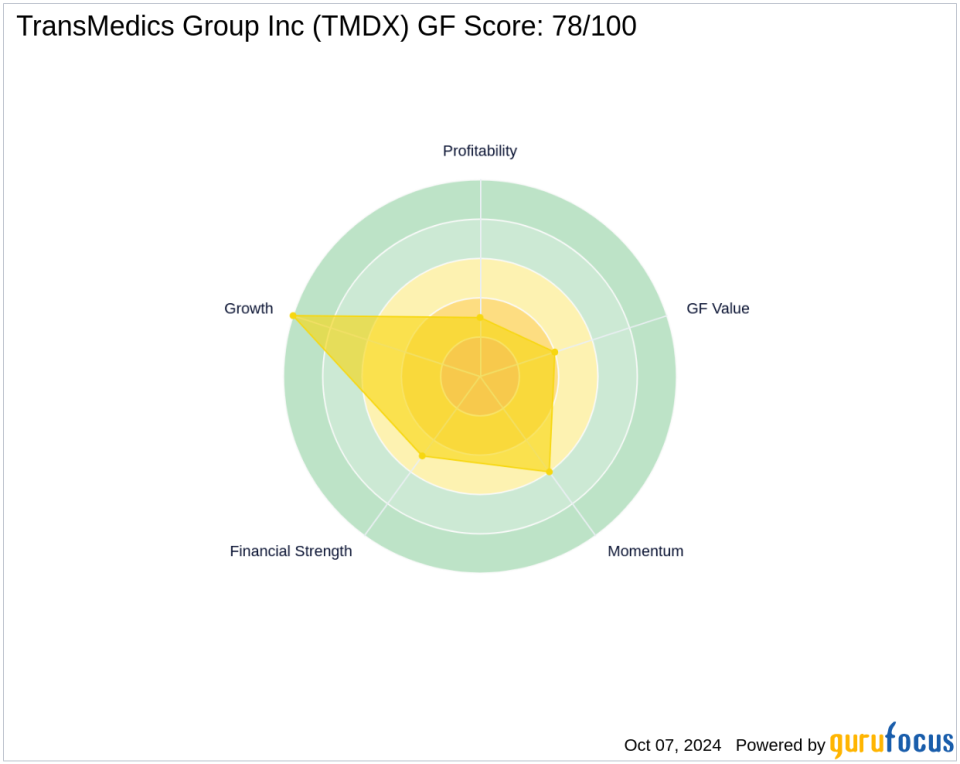

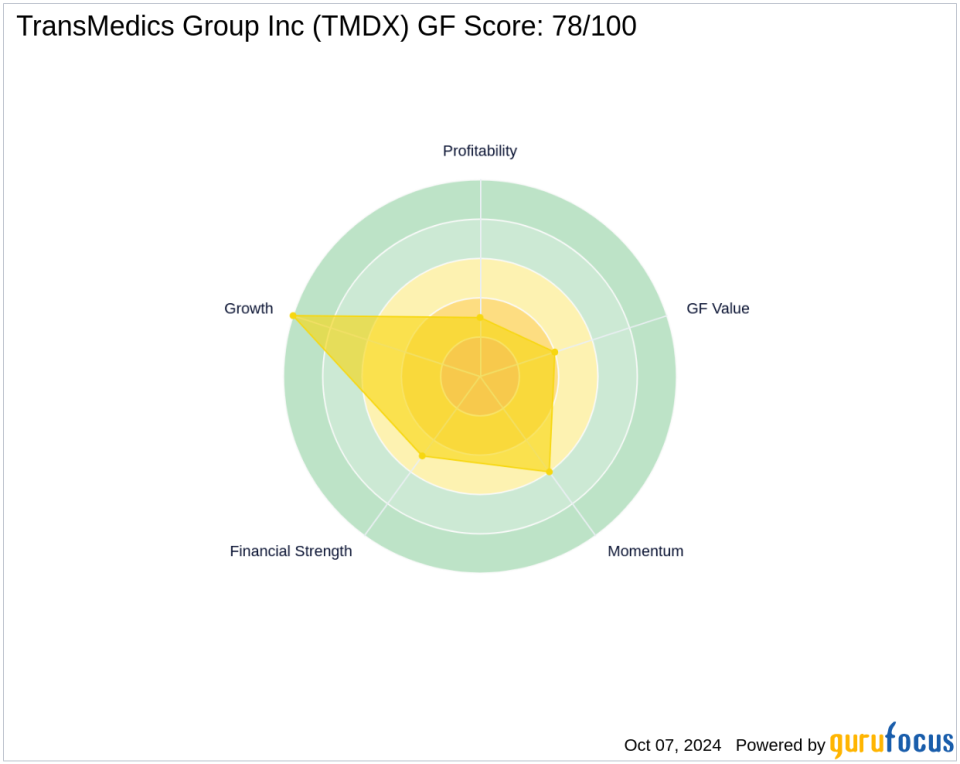

TransMedics’ Market and Financial Standing

Despite the high PE ratio, TransMedics’ stock has a GF Score of 78/100, indicating a strong potential for future performance. The company’s financial health, as indicated by its Financial Strength and Profitability Rank, shows mixed signals with excellent growth metrics but average profitability and financial strength. This complex financial landscape requires careful analysis for potential investors.

Strategic Implications for Investors

The decision by FMR LLC (Trades, Portfolio) to reduce its stake in TransMedics might be driven by the current overvaluation based on GF Value, suggesting caution. Investors should consider this move as part of a broader strategy that possibly aims to capitalize on recent gains or reduce exposure to potential downturns in the biotech sector. This adjustment in FMR LLC (Trades, Portfolio)’s portfolio could signal a critical reassessment of TransMedics’ valuation and growth prospects, influencing other investors’ perceptions and strategies in the healthcare investment landscape.

Conclusion

FMR LLC (Trades, Portfolio)’s recent transaction involving TransMedics shares underscores a strategic shift that could have broader implications for the market. As TransMedics continues to innovate in the organ transplant sector, investors and market watchers will be keenly observing the impact of such significant portfolio adjustments by major institutional investors like FMR LLC (Trades, Portfolio).

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.