In a week marked by the Fed’s decision to cut interest rates, Chinese equities saw a notable rise despite some disappointing economic data. The Shanghai Composite Index and the blue-chip CSI 300 both posted gains, reflecting investor optimism amid broader market shifts. When evaluating growth stocks with high insider ownership in this context, it’s essential to consider companies that not only show robust performance metrics but also have strong internal confidence from their leadership.

Top 10 Growth Companies With High Insider Ownership In China

|

Name |

Insider Ownership |

Earnings Growth |

|

ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) |

18% |

28.7% |

|

Jiayou International LogisticsLtd (SHSE:603871) |

22.6% |

24.6% |

|

Western Regions Tourism DevelopmentLtd (SZSE:300859) |

13.9% |

39.2% |

|

Arctech Solar Holding (SHSE:688408) |

38.6% |

29.9% |

|

Quick Intelligent EquipmentLtd (SHSE:603203) |

34.4% |

33.1% |

|

Suzhou Sunmun Technology (SZSE:300522) |

36.5% |

67.5% |

|

Sineng ElectricLtd (SZSE:300827) |

36.5% |

41.7% |

|

UTour Group (SZSE:002707) |

23% |

25.2% |

|

BIWIN Storage Technology (SHSE:688525) |

18.8% |

116.8% |

|

Offcn Education Technology (SZSE:002607) |

25.1% |

75.7% |

Let’s dive into some prime choices out of the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fujian Apex Software Co., LTD operates as a professional platform software and information service provider in China with a market cap of CN¥5.43 billion.

Operations: Fujian Apex SoftwareLTD generates revenue primarily from its Application Software Service Industry segment, amounting to CN¥730.07 million.

Insider Ownership: 32.7%

Fujian Apex Software Co., LTD, a growth company with high insider ownership in China, reported a slight decline in sales and net income for the first half of 2024. Despite this, its earnings are forecast to grow significantly at 23.52% per year over the next three years, outpacing the market average. The company trades at good value compared to peers and is expected to achieve high returns on equity (20.3%). However, its share price has been highly volatile recently.

Simply Wall St Growth Rating: ★★★★★★

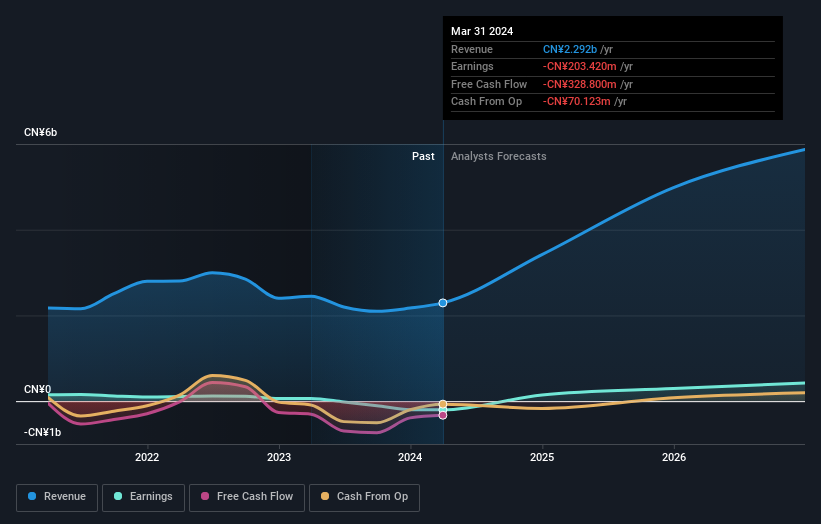

Overview: Unionman Technology Co., Ltd. produces, sells, and services multimedia information terminals, smart home network communication equipment, IoT communication modules, optical communication modules, smart security equipment, and related software systems and platforms with a market cap of CN¥4.10 billion.

Operations: Unionman Technology Ltd. generates CN¥2.35 billion in revenue from its computer, communications, and other electronic intelligent equipment manufacturing industry.

Insider Ownership: 32.5%

Unionman Technology Ltd. reported a revenue increase to CNY 1.34 billion for the first half of 2024, up from CNY 1.16 billion a year ago, though it also saw a net loss of CNY 54.44 million compared to last year’s CNY 28.4 million loss. Despite the losses, analysts forecast strong revenue growth at 33.4% per year and an impressive annual profit growth rate of 86.58%, with profitability expected within three years and high insider ownership aligning management interests with shareholders’.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector within Southeast Asia and has a market cap of CN¥4.15 billion.

Operations: The company’s revenue segments include CN¥2.13 billion from its Packaging Business and CN¥3.62 billion from its E-Commerce Business.

Insider Ownership: 35%

Xiamen Jihong Technology’s revenue for the first half of 2024 was CNY 2.41 billion, down from CNY 3.10 billion a year ago, with net income decreasing to CNY 72.36 million from CNY 189.45 million. Despite this decline, analysts forecast significant earnings growth at 30.87% per year and revenue growth at 19.8% per year, both outpacing the market averages. The company completed a share buyback plan worth CNY 86.02 million in August, indicating strong insider confidence.

Make It Happen

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603383 SHSE:688609 and SZSE:002803.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]