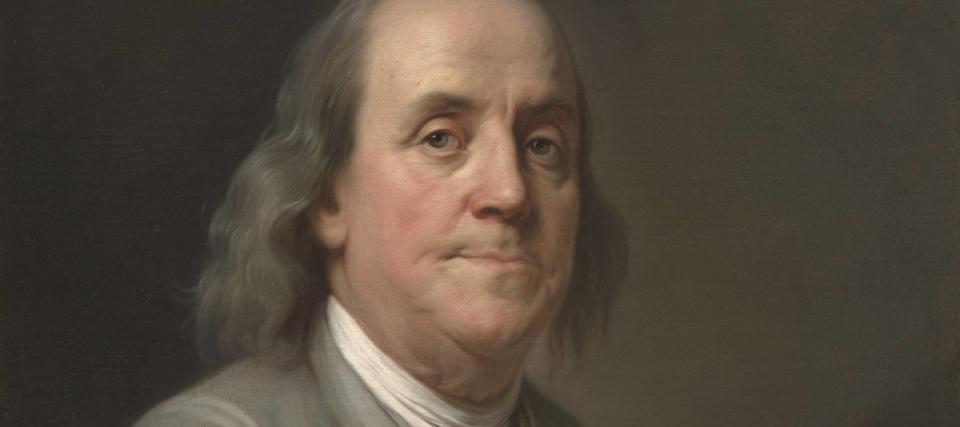

Staring out from the $100 bill, looking more like a wise old uncle than Founding Father, Benjamin Franklin seems an easy guy to like. And if anyone belongs on U.S. currency it’s this colonial polymath who dished financial wisdom as fit for today as when he signed the Declaration of Independence at age 70.

Let’s start, though, by getting this myth out of the way: Franklin never exactly said, “A penny saved is a penny earned.” The line he wrote in his 1737 edition of “Poor Richard’s Almanack” was this: “A penny saved is two pence clear.”

Don’t miss

-

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

-

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

Regardless, a penny saved in 1737 would be worth 79 cents today, per the Official Data Foundation. And by offering sound advice like the above, it’s no stretch to call Franklin one of America’s original financial gurus.

Among the many things he said about personal finance, these four are drawn from “The Way to Wealth,” a collection of adages and advice published in 1758 that were imparted in previous “Almanack” writings.

No pain, no gain

“There are no gains without pains,” he wrote.

And you thought some buff weightlifter made this up. Franklin was vocal about the dangers of sloth (including excess sleep) and urged people to pursue wealth through industriousness. He cites a gripe as common then as now among people who struggle with money: high taxes. But wishing for outside factors to change, he argued, is never as effective as taking charge through diligence.

“He that lives upon hope will die fasting,” Franklin wrote, while the industrious “shall never starve … at the working man’s house hunger looks in, but dares not enter.”

Consider Franklin’s counsel as an invitation to find and maintain income streams beyond your day job. Maybe start a side hustle out of your home and grow it from there.

Be frugal

“We must add frugality, if we would make our industry more certainly successful,” Franklin wrote. “You may think , perhaps, that a little tea or a little punch now and then, diet a little more costly, clothes a little finer, and a little entertainment now and then, can be no great matter, but remember, many a little makes a mickle. Beware of little expenses. A small leak will sink a great ship.”

The most recent figures from the U.S. Bureau of Labor Statistics show that, in 2022, Americans spent 10.9% more on apparel and services, including 18.8% more on footwear, than the previous year. While that’s not the same as splurging on a sea cruise, ask yourself whether slowly filling your closet points to a spending problem — that proverbial capsizing ship. Or, as Franklin lamented, “When you have bought one fine thing, you must buy 10 more.”

Read more: Rich, young Americans are ditching the stormy stock market — here are the alternative assets they’re banking on instead

Avoid debt

Franklin did not mince words with this tidbit: “Think what you do when you run in debt; you give to another power over your liberty.”

According to the Consumer Financial Protection Bureau, financial institutions super-boosted credit-card APRs from 12.9% in late 2013 to 22.8% in 2023, seizing on the opportunity to profit off interest charged to borrowers.

Following Franklin’s advice, spending less than you make works best. Here’s his literal food for thought: “Rather go to bed supperless than rise in debt.”

Save while you can

While it’s hard to imagine your financial adviser speaking in couplets, Franklin’s wisdom rested in sayings that were catchy, not preachy. On saving, he opined: “For age and want, save while you may; no morning sun lasts a whole day.”

An excellent savings vehicle that follows Franklin’s fondness for investing is an employer-sponsored retirement plan. This need not be a painful paperwork exercise, as many workplaces now offer automatic enrollment plans. Workers with access to such plans saved an average of 12.3%, a number that includes company matches, according to the 2024 Vanguard report “How America Saves.”

For all Franklin’s sage advice, he signed off in “The Way to Wealth” by suggesting, with wit and resignation, that people exposed to it would likely still rather blow their money on stuff:

“The people heard it, and approved the doctrine, and immediately practiced the contrary, just as if it had been a common sermon; for the [public auction] opened, and they began to buy extravagantly.”

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.