Are you one of the people who gives the ‘card’ Why do you work for that? Surely your eyes have popped out more than once when you realize the balance to pay for your creditand you don’t know exactly what you spent on or the products you are paying for.

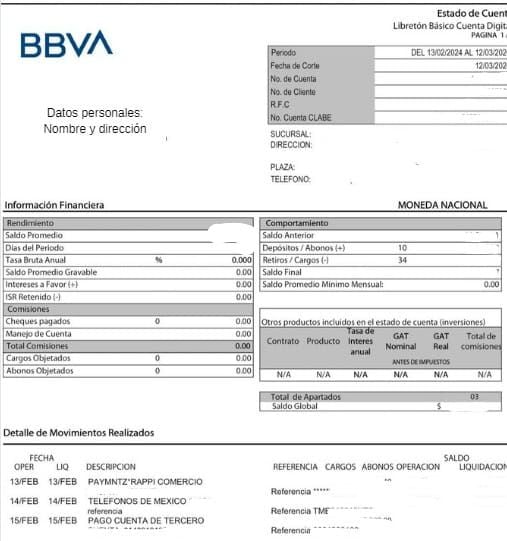

Therefore, banking institutions have the obligation to send you the account statement of your credit card, which is the document in which you can review the movements made during the monthin which reflect your consumption, transferspayments received, withdrawals, use and payments of credits.

Pay close attention to your account statusas it allows you to analyze how your finances behaved so that, if necessary, you can make an adjustment to your budget, establish fixed expenses and cut the so-called ‘ant’ expenses.

What are the elements of an account statement?

According to the National Commission for the Protection and Defense of Users of Financial Services (Condusef) It is possible to receive this document physically or by electronic means.

Currently, the account statement has the following elements:

- Detail of movements: This section breaks down all the transactions you made during the billing cycle both charges and purchases as well as payments, credits and bonuses.

- Total amount to pay: Includes the outstanding balance for purchases you made and any interest or additional charges.

- Available credit line: Indicates the amount available in your line of credit.

- Cutoff date: It is the day on which the bank closes your account with all the expenses you made in the last 30 days.

- Payment date: The deadline day to make the payment and avoid late payment is specified.

Some banking entities also include in the Account statements information about him Total Annual Cost (CAT), he minimum payment required and other relevant account detailsbut the formats are not always the same as the graphic design and the specific location of certain information changes.

What changes will my account statement have starting in October?

By official provision, starting next October, Credit Institutions and Multiple Purpose Financial Companies, Regulated Entities that issue Credit cards, They must give users the account statement with a universal formatso that you can understand in a simpler and clearer way the use you give to your plastic.

The new universal format must contain information about the payment requiredthe period, the cut-off date and the payment deadline, as well as the payment so as not to generate interest.

You should also have estimates of how much you would pay in total interest for your line of credit and the time it would take to pay off your debt if you do so paying only the minimum, or twice and up to five times the minimum, so that you can make better payment decisions that translate into significant savings for your pocket and avoid getting into excessive debt.

The Condusef indicates that it must contain the summary of charges and credits for the periodthe amounts of interest and commissions both for the period and the accumulated amount you paid in recent months, considering the annuity commission or by administration, to help you understand the costs of your credit.

The new format also requires issuing precise information about the CAT and the Annual interest rate Ordinary (fixed or variable); the level of credit card usage, balances (including the total debit balance), your credit limit, available credit, and if necessary, the information on other lines of credit and additional cards.

You should also be informed by the balance on which interest for the collection period was calculatedas well as the distribution of your payments and credits in purchases and revolving and deferred charges to months, interests, commissions, VAT and, where applicable, the positive balance.

Another important aspect is the breakdown of movements for purchases and deferred charges to months or partial payments with or without interest, through which you will know the transaction date, the original amount, the pending balance, the partial payment required, the payment number and the applicable interest rate.

It will also contain a section with information on unacknowledged chargeswhich must explain the details of your complaint, the date of the operation, date of receipt of the claim, the description of the charge, its status, the report folio and the amount affected. This information will no longer appear on the account statement once the claim is concluded.

Likewise, data from the Specialized User Service Unit (UNE) and the Condusef, so that you can present your complaints and a section called: Restructuring your debt, in case you have reached an agreement with the institution, which must indicate the terms and conditions.

In summary, with the new universal account statement you will better understand the use you are giving to your credit and it will allow you to compare it more easily with others cards.

Take care of your finances! Follow these tips for the proper use of your card

So that you do not end up at zero before the fortnight’s deposit, Condusef issued the following recommendations

- Avoid having cash on your credit card, as it can be expensive, since some banks require a commission of up to 10 percent.

- Verify that the amount you are going to sign for is correct.

- Yeah purchases monthly without interest, Follow this rule: what you buy should last longer than the time it takes you to pay for it, for example a refrigerator or remodeling your house.

- Use the card as a means of payment according to your budget and take advantage of the benefits such as points and refunds.

- Save all your vouchers and receipts to verify the correct application of your movements in your account statement.

- Use your plastic responsibly, remember that It is not extra money from your income.

- Request the sending of your account statement through the means that is most convenient for you.